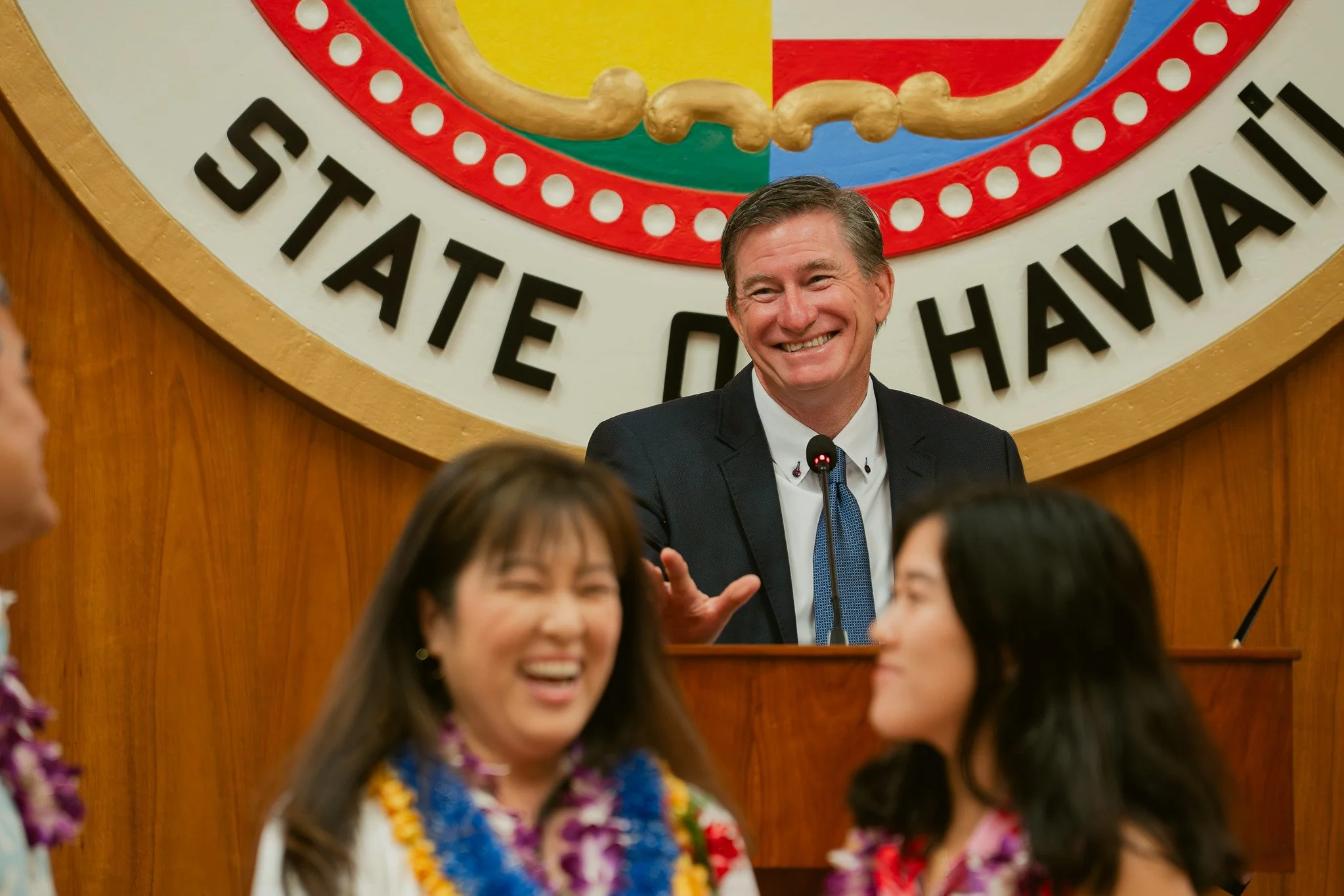

TOMMY WATERS

Council Chair & District IV Councilmember

Hawai‘i Kai, Kuli‘ou‘ou, Niu Valley, ‘Āina Haina, Wailupe, Wai‘alae Iki, Kalani Valley, Kāhala, Wilhelmina Rise, Kaimukī, Kapahulu, Diamond Head, and Waikīkī.

Current Term

2019 - 2027

Committees

Executive Management, Chair

Zoning & Planning, Vice Chair

Budget

International & Legal Affairs

Tommy Waters is the Chair of the Honolulu City Council and represents District 4, which includes communities such as Hawai‘i Kai, Kuli‘ou‘ou, Niu Valley, ‘Āina Haina, Kāhala, Kaimukī, and Waikīkī. A lifelong resident of Hawaiʻi, Waters has dedicated over 30 years to public service, encompassing roles as a public defender, state legislator, and community advocate.

Tommy graduated from Kamehameha Schools in 1983. He earned a B.A. in Political Science and Speech from the University of Hawai‘i at Mānoa in 1989 and a J.D. from the William S. Richardson School of Law in 1993. He began his legal career as a public defender, focusing on representing underserved communities.

From 2002 to 2008, Tommy served in the Hawai‘i State House of Representatives, representing District 51. During his tenure, he chaired the Judiciary and Higher Education Committees and served as Majority Whip. In 2019, he was elected to the Honolulu City Council and became Council Chair in 2020. He was re-elected in 2022, with his current term extending through 2027.

As Council Chair, Tommy has prioritized public safety, affordable housing, infrastructure, and fiscal responsibility. He has introduced resolutions to enhance police accountability and transparency, including empowering the Police Commission to hold police chiefs accountable for misconduct and mismanagement. To address housing affordability, he has advocated for comprehensive policy reforms and increased investment in affordable housing initiatives.

Tommy is actively involved in community service, having served on the Neighborhood Board and volunteered with organizations such as the Native Hawaiian Legal Corporation and the Ka Wai Nui Marsh Task Force. He encourages public participation in government processes, urging residents to engage in live hearings and contribute to community development.

He is a devoted father to two children, Emma and Kai, and resides in Kaimukī.

Should you have any questions, please feel free to call my office at (808) 768-5004 or email tommy.waters@honolulu.gov.

Mahalo,

Newsletters

2022

December Neighborhood Board Updates

Hawai‘i Kai | Kuli‘ou‘ou/Kalani Iki | Wai‘ialae/Kāhala | Kaimukī | Diamond Head/Kapahulu/St. Louis Hts. | Waikīkī

Get Connected

Get connected with our office by filling out the contact form or contact our team by phone or email.

Phone: (808) 768-5004

Email: tommy.waters@honolulu.gov

Report a City Issue

Request a Service. Report an Issue, and Help Improve your Community!

Access Honolulu 311 here: Honolulu 311 App.

Stay Connected

Expenditure Reports

Travel Reports

Councilmember Travel

Event

2023 NACo Legislative Conference

Feb. 11-14, 2023

Staff Travel

Event

2023 NACo Legislative Conference

Name: April Coloretti

Feb. 11-14, 2023